Aurora Cannabis: Smart Decisions

Aurora Cannabis reported a horrible FQ1 quarter.

The cannabis company made a smart decision to raise cash and cut capital spending by C$190 million.

Cash remains a major problem requiring likely shareholder dilution to fund ongoing negative cash flows.

The stock's market value at $3.4 billion is still high, but the company does have catalysts in 2020 positioning a near-term pivot to a bullish view.

For the last year, the Canadian cannabis space was obviously headed to an oversupply scenario, yet companies like Aurora Cannabis (ACB) famously charged forward with more facilities. Along with the FQ1 report, the company finally rationalized supply to conserve cash. The move was very smart, but my investment thesis is still neutral on the stock due to the valuation while waiting for some bullish long-term themes to play out as the industry shakes out in the next few quarters.

Read the full article on Seeking Alpha.

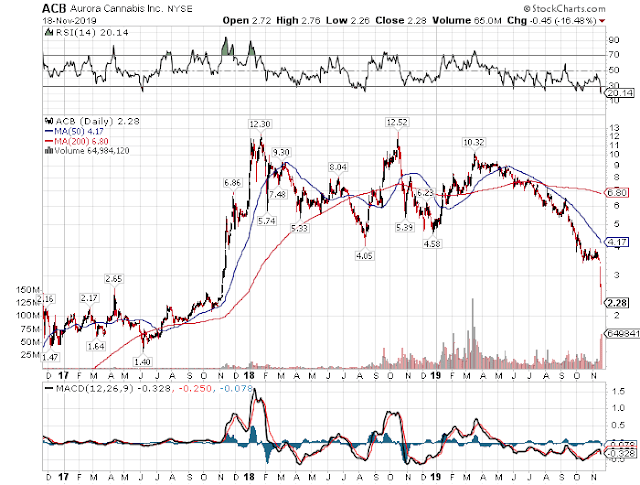

Update - November 18

The stock took a major 16.5% hit on Monday. My article was submitted over the weekend before the collapse. My thesis is generally that Aurora Cannabis hits some support around $2 where the market cap dips to $2.4 billion.

The chart appears to support his level as an initial test.

Disclosure: No position mentioned. Please review he disclaimer page for more details.

Comments