Out Fox The $treet - December 31, 2019

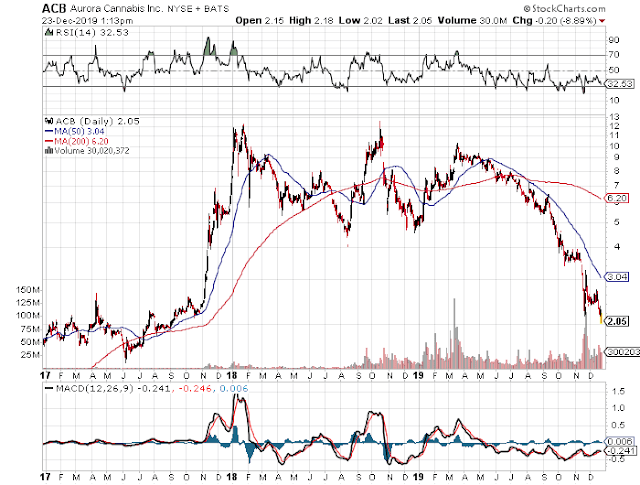

Stocks to watch on the last day of 2019: AMD (AMD) - Rosenblatt raises the price target for the chip stock to $65. Analyst Hans Mosesmann has a similar view on the stock as Stone Fox Capital. The stock remains extended as 2019 comes to close. Investors will want to look for a pullback to start 2020 after the massive year end rally. Cronos Group (CRON) - pot stocks are seeing a big rally to end 2019. Cronos Group is up 17%, but the move just appears a dead cat rally. Don't chase any of the Canadian cannabis stocks higher. Disclosure: No position. Please review the disclaimer page for more details.