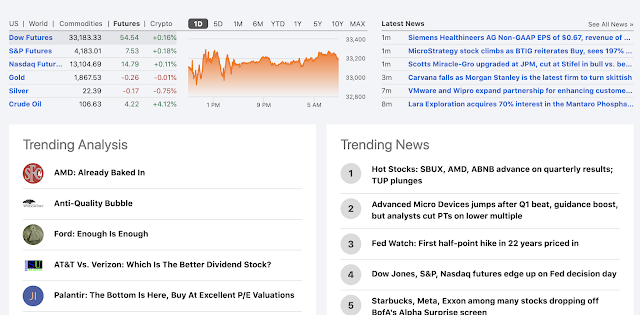

AMD: Already Baked In

- AMD is now priced for serious weakness in the chip business while the data continues to support strong growth.

- The company remains supply constrained with Intel still forecasting chip challenges until 2024.

- The stock trades at only 15.5x '23 EPS targets, providing plenty of cushion for unexpected weakness.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

Advanced Micro Devices (NASDAQ:AMD) has fallen a massive amount this year that any major cut to financial targets is already baked into expectations. Amazingly, the chip company has faced a multi-year issue with supply constraint problems, yet the stock market built a view of supply needing to already be cut. My investment thesis remains ultra Bullish on the chip company now trading below $90 due to the Intel (INTC) earnings disappointment.

Top trending article on Seeking Alpha.

Disclosure: No position mentioned. Please review the disclaimer page for more details.

Update - May 19

As SFC pointed out in this report and the follow up on May 11, AMD wasn't priced for the ongoing growth plan. A move above $100 sets up a bullish rally for the rest of the year.

Comments